Which of the Following Is Needed to Calculate Profit

Cm ratio unit sales and total fixed costs. Net sales revenue - cost of sales.

Profit Percentage Formula Examples With Excel Template

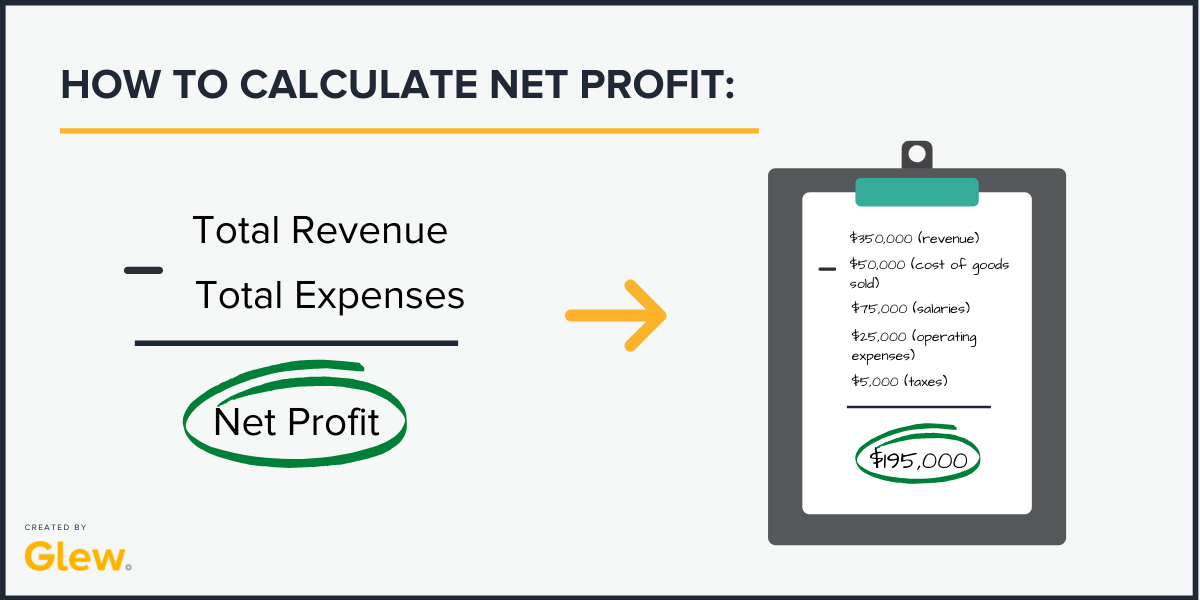

Where Net Profit Revenue - Cost.

. The formula to calculate profit is. Which of the following is an advantage of online legal research. Net profit Gross profit - Expenses.

Profit P - V X Q - Fixed expenses. Assume that Campbells net sales for the first four months of 2015 totaled 27 billion. Refer to the following mentioned data.

Again the formula for profit per unit can be derived by deducting the cost price of production from the selling price of each unit as shown below. The cost price is abbreviated as CP and the selling price is abbreviated as SP. Profit margin on sales 7.

B Net Profit Margin. Thus the formula to calculate profit is given by. Asset turnover ratio 6.

B Explain the limitation of ratio in a business. Is a technology that allows users to access databases that contain case law or statutory law governing a particular issue. I Return on Assets.

You calculate the net sales by following this formula. Suppose the average value of in-kind transfers increases by. Profit Gross margin - Fixed expense B.

Profit percentage is similar to markup percentage when you calculate gross margin. Relevance and Uses of Profit Formula. Gross profit revenue - direct materials direct labor factory overhead 2.

Profit per unit Selling Price Cost Price. It is the sales volume in dollars that company needs to generate to earn a desired profit target profit in a particular business period in future. Unit cm unit sales and total fixed costs.

Return on equity 9. Calculate the gross profit ratio for each of the past three years. The PV ratio which establishes the relationship between contribution and sales is.

Profit Unit contribution margin x Unit sales - Fixed expense D. Cm ratio and total fixed costs. Do not round intermediate calculations and round your final answers to 2 decimal places days days 1.

Operating Profit Margin Operating Profit Revenue x 100. Below is a breakdown of each profit margin formula. Gross Profit Sales Purchases Direct Expenses.

For businesses profit is often calculated by profit. However if the cost of sales of your business is in excess of sales revenue it results in Gross Loss for your business. 4000 units 80 320000.

Thus the formula for calculating Gross Profit is as follows. G Accounts Payable Turnover Ratio. A Gross Profit Margin.

When assessing the profitability of a company there are three primary margin ratios to consider. Given the following information calculate profit. You do this by following this equation.

Return on assets 8. Management accounting isnt really my area of expertise but from a quick google search looks like the question just wants allocate the fix overhead to the 20000 frames which would be 15unit. It is often useful to express the simple profit equation in terms of the unit contribution margin Unit CM as follows.

Calculate an estimated cost of goods sold and gross profit for the four months using the gross. Calculate the following Ratios. PV Ratio 20 1520 100 520 100 25.

Unit cm unit sales and total fixed costs. Inventory turnover ratio 2. Receivables turnover ratio 4.

Calculator generates this figure by dividing the total sales in dollars. Net Profit Margin Net Profit Revenue. The company will need to sell 4000 units of product X to earn a profit of 80000.

Break-even point Unit Sales Fixed Expenses Unit CM. Unit cm and total fixed costs. Thus if selling price of a product is Rs.

This ratio can also be shown in the form of percentage by multiplying by 100. Profit Total Sales Total Expense. The sales volume in units needed to generate the target profit.

Indirect costs are also called overhead costs like rent and utilities. Consider 365 days a year. Selling price per unit 15000 Variable cost per unit 12000 Fixed costs 1000 Number of units 100.

D Quick Acid Ratio. How to calculate profit. This is the percentage of the cost that you get as profit on top of the cost.

Refer to the following mentioned data. In order to calculate net profit a business will use the following formula. Unit CM Selling price per unit - Variable expenses per unit P - V.

Total Revenue - Total Expenses Profit. Which of the following is the equation to solve for profit in terms of sales volume. To calculate the gross profit margin you would need to follow three steps.

Calculate an estimated cost of goods sold and gross profit for the four months using the gross profit ratio for 2014. Calculate the gross profit ratio for each of the past three years. For gross profit gross margin percentage and mark up percentage see the Margin Calculator.

Direct costs can include purchases like materials and staff wages. Gross operating and net. Profit Selling price per unit x Unit sales - Fixed expense C.

Determining the net sales. Gross Profit Margin Gross Profit Revenue x 100. Profit is determined by subtracting direct and indirect costs from all sales earned.

20 and variable cost is Rs. 15 per unit then. E Inventory Turnover Ratio Days f Accounts Receivable Turnover Ratio.

Target profit fixed expensescontribution margin per unit. Profit P X Q - V X Q - Fixed expenses. Profit Selling price per unit x Unit sales - Variable cost per unit x Unit sales.

Thus Gross Profit is arrived at by deducting the cost of goods sold from sales. Round your answers to 2 decimal places Assume that Campbells net sales for the first four months of 2012 totaled 1278 billion. Profit P X Q - V X Q - Fixed expenses.

Thus the profit of the product can be determined by taking the difference between the cost price and the selling price. To get net profit simply SPunit - VCunit - FCunit Net Profitunit. Gross Profit Total revenue Cost of Sales.

Net profit margin 42 billion 2906 billion 100 1445. Target Profit Fixed ExpensesCM. The calculator will generate the following outputs for you.

Average days in inventory 3. Calculate the gross profit. Net Profit Margin Net Income Revenue x 100.

Average collection period 5. Or PV Ratio Change in profit or ContributionChange in Sales. This example illustrates the importance of having strong gross and operating profit margins.

We can calculate the sales in dollars by simply multiplying the number of units to be sold by the sales price per unit as follows.

Profit Margin Formula Uses How To Calculate

Comments

Post a Comment